Revitalizing Sick Real Estate Projects in India

Understanding the present scenario

- Numerous real estate projects in India are stalled

due to financial constraints, regulatory hurdles, and

market downturns. - Major urban centers like Maharashtra, Delhi, and

Haryana are significantly affected by these stalled

projects. - Key factors include liquidity issues, delayed

approvals, and legal disputes. - Reviving these projects offers opportunities for

economic growth, job creation, and urban

development. - Adequate investment and regulatory support are

essential for rejuvenating these sick projects and

boosting the real estate sector.

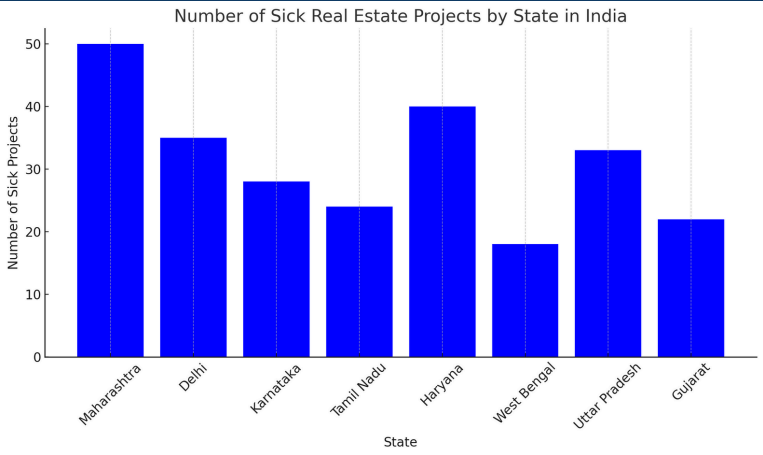

Here’s the bar graph showing the number of sick real estate projects by state in India. This graph provides a visual representation of where the maximum such properties are available, with Maharashtra, Haryana, and Delhi having the highest numbers of sick projects.

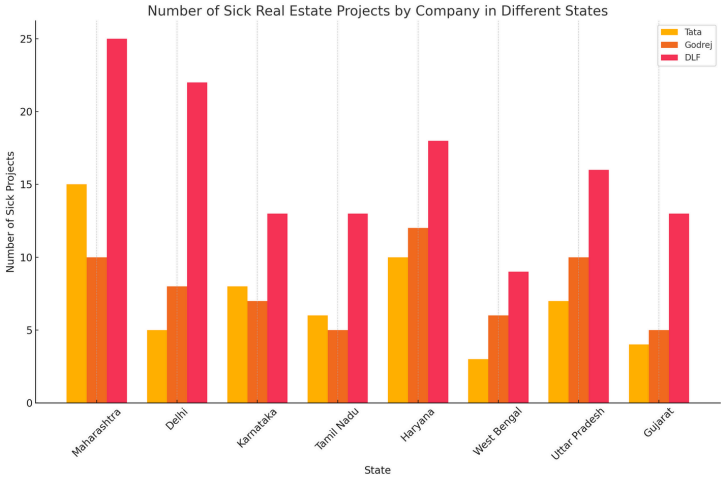

- DLF consistently has the highest number of sick projects across all states, indicating potentially larger scale developments that have faced challenges.

- Godrej and Tata also have a significant

number of sick projects, but generally fewer compared to DLF. - Maharashtra, Delhi, and Haryana are the states with the highest number of sick projects across all three companies, highlighting major opportunities for intervention an revitalization efforts.

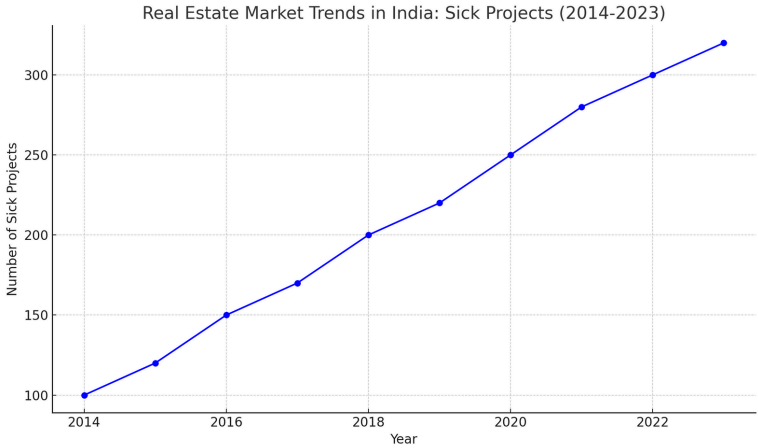

This trend highlights the growing need for intervention, providing opportunities for investors to acquire and revitalize these projects.

Now that we are convinced, that the problem is real - LET’s DIG IN

Acquisition Strategy

Prioritizing projects by Tata Housing, Godrej Properties, and DLF ensures a higher likelihood of successful revitalization due to their established reputations and market presence.

Investment Landscape

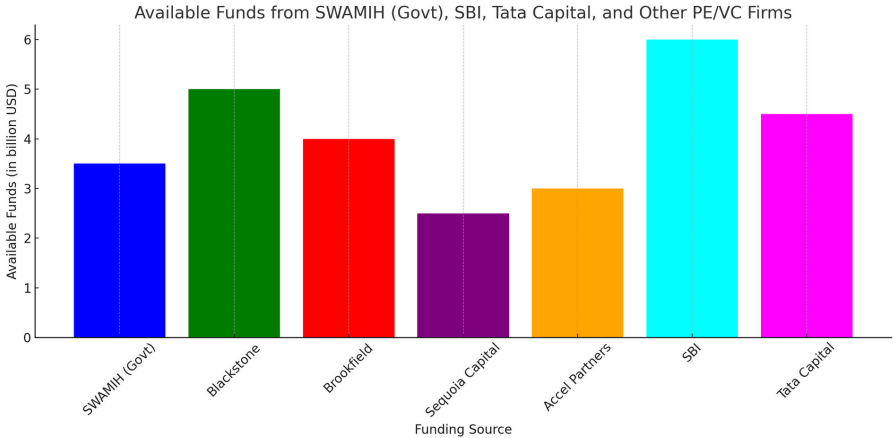

Engaging with government funds, financial institutions like SBI, and venture funds such as Tata Capital can provide the necessary financial backing for these projects.

- Diversified Funding Sources: The availability of funds from a mix of government, banking, and private equity/venture capital sources provides a diversified financial base for project revitalization.

- Strategic Partnerships: Forming strategic partnerships with these funding sources can ensure a balanced and comprehensive approach to financing and executing the projects.

- Government and Private Sector Collaboration: Collaboration between government-backed funds (SWAMIH) and private sector investors can create a synergistic effect, leveraging both public support and private sector efficiency.

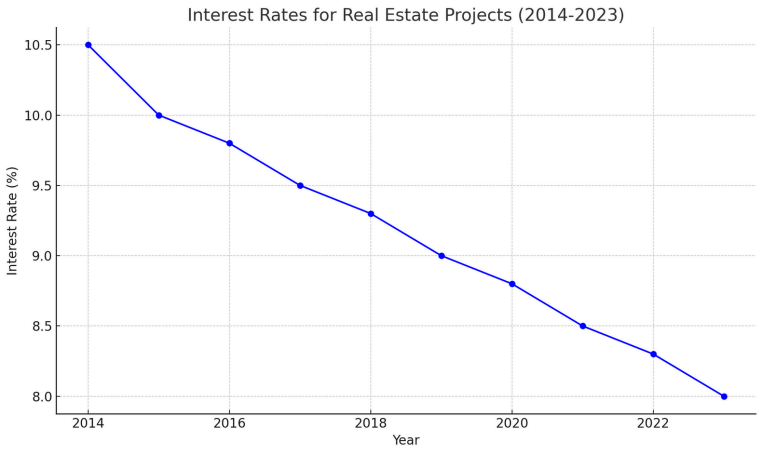

- Economic Factors:

The decline in interest rates can be attributed to various economic factors, including monetary policy easing by

the Reserve Bank of India (RBI), aimed at stimulating investment and growth in the real estate sector. - Lower interest rates reduce the cost of

borrowing, making it more attractive for

developers and investors to finance

new and ongoing projects

Identifying and Mitigating Risks in Revitalization Projects

- Legal Risks: Potential legal disputes and compliance issues.

- Financial Risks: Budget overruns, funding shortages, and financial instability.

- Market Risks: Fluctuations in market demand, pricing challenges, and competition.

EXIT STRATEGIES

It is essential to prioritize exit strategies that balance immediate capital returns, risk mitigation, and long-term value creation. The strategic sale offers immediate liquidity and risk transfer, REITs

provide liquidity and stable income with potential for market appreciation, and long-term leasing ensures steady cash flow and enhanced property value

- Partner with or sell the project to larger real estate developers or investment firms.

- Immediate Capital Return: Quick infusion of capital by selling the project at a competitive price.

- Convert the project into a REIT and sell shares to investors.)

- Liquidity: Provides investors with a liquid

investment option through tradeable shares. - Stable Income: Continuous income from rental yields, contributing to steady cash flow.

- Market Appreciation: Potential for capital gains as REIT shares appreciate in value over time.

- Secure long-term lease agreements with commercial tenants.

- Retained Ownership: Maintain ownership of the property while generating consistent revenue, allowing for future appreciation or sale.